Which Investment Was More Profitable, Twitter or Paranormal Activity?

Note from the Web Port: Not all blogs are evergreen. This has nothing to do with Elon Musk, or the state of the platform in 2023. This is an older blog I wrote to illustrate tech breakouts vs. film breakouts. The principle remains, but it’s aged a bit like fine milk. I’m leaving it up as a solid illustration though, since this is basically a 7 part thought experiment. If I were to do it again, I’d compare Skinamarink and Outbrain, Bumble, or DuoLingo. If I get some comments requesting it, I will. Probabably as a video.

BEGIN BLOG PORT

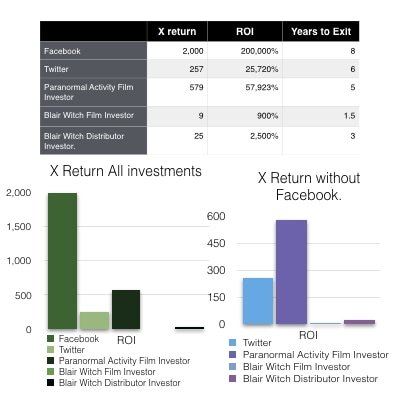

Every tech investor is looking for the next Snapchat, Twitter, or Facebook, and every filmmaker thinks their project will be the next The Blair Witch Project, Paranormal Activity, or Insidious. While there are lots of reasons this ideology is similar, they are far from the same. This week, we’re going to take a look at what an early stage investor in each of these projects or companies would have walked away with.

Films have breakouts, tech has Decacorns. While an interesting word, a Decacorn is easy to describe. It’s a company worth 10 billion or more pre-exit.

Defining a breakout film is somewhat more difficult. There are many ways one could describe a breakout film. In an article for the American Film Market Industry analyst Stephen Follows and Bruce Nash of The-Numbers.com defined it as a film budgeted between 500k and 3 million dollars that the returns to the producer were more than 10 million dollars.

Another way to look at it would be any film that returned their investors at least 10 times what they put in (10X) Perhaps with a minimum return around half a million dollars to avoid a 500 dollar film making 5,000 dollars being considered a breakout. Technically, the two examples of highest ROI films most people think of fall outside this realm.

We’ll be looking at the films people generally think of as winning investments, against the tech companies investors would love to have put some money in early on.

I’m sure every tech investor reading this is thinking a film investment doesn’t really stand a chance. In most instances, they’re right. However, purely as a thought exercise, let’s look at the numbers.

The seed round for Facebook was 500,000 Dollars, and if you’re an aspiring Venture Capitalist or a big fan of Darren Aronofsky, you know that largely came from Peter Thiel of Founders Fund. By the time he cashed out, his initial 500k investment netted him around 1 billion dollars. That’s a return on investment of more than 2,000X! Not all of the money went to him, but a significant portion did. That’s according to this CNN article.

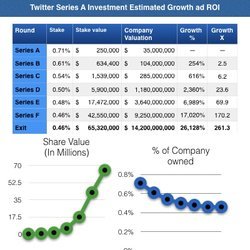

I couldn’t find another similar investment profile for Twitter. Perhaps because no one made a movie about it. So we’re going to have to extrapolate a bit, and estimate what a Series A Investor would have gotten from their investment using largely standard practices and math.

Crunchbase doesn’t have an exact amount that any individual invested, but since it was into a Series A round of 5 million dollars with 11 other investors several of them funds it’s reasonable that a single angel investor could have invested around 250k. Given that 250k investment was against a valuation of 35 million, that means this investor had owned 0.71% of Twitter.

Now, just because this nameless investor owned 0.71% of Twitter then, that doesn’t mean it stays at that percentage. Any time new stock is issued, that share dilutes. Given the valuations of future rounds, we can assume that the 0.71% of the company diluted to around 0.45% of the company by the time the company exited. Given that the company was evaluated at 14.2 billion dollars when Twitter IPO’s in 2013, the initial investment of 250k was worth 65.3MM. That means a 261X return

A 250X to 2,000X is a phenomenal possibility, and they're not the only tech companies to have offered such gigantic returns to their early investors. So how does film stack up?

Let’s look at the Blair Witch Project. According to this article from movienomics, the Blair Witch Project Sold at Sundance for 1 million USD. Since the Budget was only 22.5k, the filmmakers made a return of 4340%, or 43X. From the filmmaker side that’s not bad, but it’s not where the story is. Artisan, the company that bought the rights to the film, spent another 1 million US in a grassroots marketing campaign, and the film went on to gross 248 Million. That means they had around a 123X return on their 2 million dollar investment.

We’re going to look at this two ways. From being an investor in the film and an investor in Artisan. If you happen to be that rich uncle who ponied up the 22.5k, you probably would be entitled to around a 20% stake given that almost all of the crew on the Blair Witch worked for free. So, you investment would return about around 200k, or nearly 9X.

What if you were an investor in Artisan? On an entirely hypothetical and not entirely connected to reality basis, let’s just say you were an angel investor who got their money from inventing a new washing machine. You sold the invention to a big company and now you’re flush with cash. You’ve always liked movies so you invest 2 million in Artisan. In return, they give you 20% of their company. So, with that 2 million dollar investment, you get a return of about 25x. That’s a very healthy number.

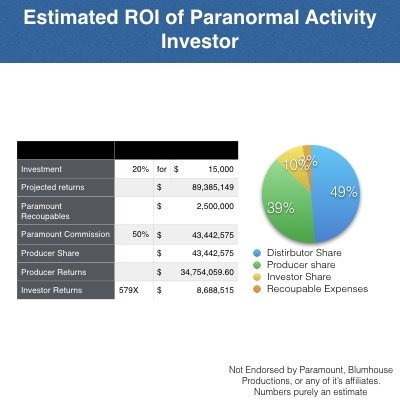

Paranormal Activity is such a low budget, the filmmakers almost certainly put it in themselves, however for the purposes of this exercise, we’re going to assume the entire 15k budget was put in by a single investor, and they took a 20% stake since the filmmakers clearly raised much more in soft costs including deferred payments and sweat equity.

Even though the first film in the paranormal activity series made about 89 million in theaters, not all of that went to the filmmakers. The theaters often keep around 50%, then the exhibitor takes another 30-50% of what’s left, and then the filmmakers and investors get a cut. Further, the distributors tend to recoup their costs first.

To simplify this, we’re assuming that around 50% of the costs go straight to the distributor, and that they recouped another 2.5 million on in expenses before they paid the filmmakers. That’s a low marketing spend, but the campaign Paramount did was very innovative and low cost.

So, if we assume everything above, 89 million gets reduced to a bit shy of 43.5 million once it reaches the Production Company. The investor is then paid out 8.7 million on their initial 15,000 dollar investment, which means a 579X ROI, roughly twice the ROI from the series A of Twitter!

So films are a better investment than Twitter, right? No. No they are not. Paranormal Activity is the highest ROI film of all time, Twitter isn’t the highest ROI tech company within 10 years on either side of it. Further, the returns I listed from Twitter are relatively well verified, I had to extrapolate the deal points for Paranormal activity based on different deal memos I’ve seen as a producer’s rep.

More than likely, the filmmakers put in the 15,000 dollar budget themselves. Even if they didn’t, given that paramount paid around 350,000 up front for Paranormal Activity, the the filmmakers wouldn’t have seen much more from it than that. After all, on paper Star Wars Return of the Jedi never broke even. If the filmmakers only got 350,000, then the investors ROI would have been more like 4.5X given that in our scenario, only owned 20% of the film.

Further, in the real world, both of these projects were largely backed by people who owned the project, and there would have been far more players in the waterfalls. So this is a fun throught experiment more than anything, and mainly proves the point that filmmakers should be focusing on other issues aside from potential ROI when selling their film.

Thanks for reading. This blog was a lot of work to port. If you’re browsing these archives and found it, you probably appreciate my work. If so, I’d ask you to sign up for my mailing list, support me on Patreon, or subscribe on substack. Thanks so much!