The Basics of Financing your Independent Film with Tax Incentives

Making a profit on an indie film is HARD. If you can get your film subsidized by a tzx incentive your job is a lot easier. Here are the basics to get you started on that path.

Most filmmakers simply chase equity in order to finance their films. However, most investors don’t want to shoulder the financial risk involved in a film alone. That’s where tax incentives for independent film can come in and help to close the gap. But proper use of tax incentives for independent film financing is somewhat complicated. Here’s a primer to get you started.

Cities, States, Regions, and countries can have tax incentives

First of all, it’s important to understand that most forms of government can issue a tax incentive. In the US, the biggest and best incentives generally (but not always) come from states, however many cities, counties, and regions may supplement those incentives with smaller Internationally, many countries also provide some level of subsidy.

Europe Tends to provide better tax incentives than the US.

From the standpoint of the federal government, most European countries are much better about independent film subsidies than the US. Most of the time, these incentives take the form of co-production funding, but it’s relatively common for film commissions to provide grants to help promote the arts among their citizens.

This is particularly notable given that citizens of EU Member States can strategically stack incentives in a way that the majority of your film is financed via government subsidies. If, like me, you are based out of the United States, that’s just not possible due to the structure of most tax incentives.

There’s normally a minimum spend.

Especially in the US, there’s generally a fairly hefty minimum spend to qualify for a tax incentive. In some states that spending can start around 1 million dollars for out-of-state productions. Some states offer a lower cap for productions helmed by residents of the state.

There’s generally a minimum percentage of the total film budget needing to be shot there.

Most of the time you’ll only be eligible for a tax incentive if you shoot a certain percentage of your film or spend a certain percentage of your budget in a given territory. These can vary widely from territory to territory so look at the first place.

It’s normally not cash upfront

Unless you’re getting a grant from whatever film commission you’re shooting in, you’re probably just going to get a piece of paper that will state that you will be audited after the production and paid out according to the results of the audit. There are generally a few different ways that a tax incentive can be structured, but we’ll touch on those next week.

You need to plan for monetizing it.

In general, you’ll either end up selling the tax incentive for a percentage of its total value to a company with a high tax liability in your state, or you’ll have to take out a loan against your tax incentive in order to get the money you need to make the film. Both of these incur some level of cost which is different depending on which state you’re shooting in.

For example, Georgia and Nevada both have transferrable tax credits. Due to the large amount of productions going on in Georgia on a pretty much constant basis, the transferrable tax credit often monetizes at around 60% of face value. Nevada on the other hand has relatively few productions and many casinos that have very high tax burdens. As a result, the tax incentive in Nevada tends to monetize at around 90%. That said, there is presumably a more tested, experienced crew in Georgia than in certain parts of Nevada, of course, the film commission will tell you differently.

Not everything is covered

Not every expense for your film is covered. Exactly what is covered can vary widely from state to state, but in general only expenses that directly benefit the economy of the state are covered. There are often exceptions. One common exception is some mechanism to allow recognizable name talent to either be included in a covered expenditure or at least exempted from minimum thresholds of state expenditures.

Most of the time, high pay for above-the-line positions such as out-of-state recognizable name talent or directors are not covered covered by tax incentives. However, there are a few states that allow it. I talk a lot about it in this Movie Moolah Podcast with Jesus Sifuentes, linked below.

Related Podcast: MMP:003 Non-Traditional Investors & Maximizing Tax Incentives W/ Jesus Sifuentes

Not every program is adequately funded

Many film programs have a “cap” If that cap is too low, the money can be gone before the demand for the money is. Some states have the opposite problem.

Communicating with the film commission pays dividends long term

In general, the film commissions I’ve talked to are extremely friendly and easy to talk to. However, many times these commissions lose touch with the filmmakers they’re supporting shortly after they shoot. This isn’t necessarily a good thing, as most film commissions have significant reach into the greater film community and other aspects of local government. If you make sure they stay up to date as to what’s going on with your project you may find yourself getting help from unexpected places.

Also, if this is all a bit complicated, you should check out this new mentorship program I’ve started to help self-motivated filmmakers get additional resources as well as get their questions answered by someone working in the field. It’s more affordable than you may think. Check out my services page for more information.

If you’re not there yet, grab my free film Business Resource package. It’s got a lot of goodies ranging from a free e-book, free white paper, an investment deck template, and more. Grab it at the button below.

Finally, If you liked this content, please share it.

Click the Tags below for more, related content!

Filmmakers Glossary of Film Investment Terminology

It’s hard to raise funding for a film, and the contracts get confusing quickly. Here’s a glossary to help you understand the mountain of paperwork you’ll need to sign to get your film financed. This blog doesn’t mean you don’t still need a lawyer (I’m not one, and this isn’t legal advice), but it will help you understand the paperwork you’re sent.

Last week I laid out a glossary of general-use film business terms, but the blog ended up a bit too long and dense to be a single post. So, I broke it into two. Last week was the basics of business terms, this week is the next level, and focuses entirely on investment terms. Some of these may seem tangential and unnecessary, however if your goal is to close an investor, you’ll need to thoroughly speak their language. If there’s something you don’t see here, check out last week’s blog here. I’m not a lawyer, this isn’t legal advice, and you should have a solid attorney on your team before trying to close an investment round. With that out of the way, let’s get started.

Capital

While many types exist, The term most commonly refers to money.

Liquid Capital

Money that can be spent immediately, or near immediately. Non-liquid capital would be considered something like real estate holdings which would first need to be liquidated in order to sell.

Principle

In finance: it’s general the initial capital investment or the remaining balance on a debt.

Interest

A percentage fee is added on to the principle of a loan or line of credit.

Compound interest

Interest on the principle of the loan and interest.

Simply: interest on interest.

High-Risk Investment

An investment where an investor may lose most or all of the money they put in. Independent Films are always high-risk investments

Securities and Exchanges Commission (SEC)

The main financial regulatory agency in the United States. It oversees most forms of investment.

Accredited Investor

A person of means who is generally considered to have enough business know-how to appraise an investment, pay someone to appraise it for them, or who wouldn’t be completely destitute from taking a high risk-gamble. As of the date of this publishing, according to the SEC the investor must meet either (NOT both of) the income or net worth requirement in order to be considered an accredited investor.

Income Requirements

1.If filing individually, a person must have made 200,000 USD a year for the past 2 years, and be likely to do the same this year.

2.If filing Jointly, a household must have made 300,000 USD a year for the past 2 years, and be likely to do the same this year.

Net Worth.

The investor or household must have 1 million dollars in net worth OUTSIDE of their primary residence.

High Net Worth Individual (HNWI)

Outside the obvious, this term is generally a financial industry term for accredited investor

Edgar Database

A database of high-risk investments maintained by the SEC that is only accessible to Accredited investors and licensed brokerage or investment firms.

Financing Round

A round of financing or funding that is large enough to take an organization or project to the next major milestone. For how this works in film, check out the youtube video I’ve linked below, and the blog linked below that.

Related Video: The 4 Stages of Indiefilm Financing

Related Blog: The 4 Stages of Indiefilm Financing

Business Plan

A document written by an entrepreneur or filmmaker outlining their investment. In the film industry, this document will also often educate the investor on how the industry functions as a whole. This document is also known as a prospectus, but that term is not as commonly used as it once was.

Private Placement Memorandum (PPM)

A document that’s filed with the SEC for investors to consider investing in your project. Frequently an attorney will base this document off of the filmmaker or entrepreneur’s business plan. In most cases, a PPM will be registered with the aforementioned Edgar database for a modest filing fee.

Pro-Forma Financial Statements

Financial documents consisting of an expected income breakdown, cash-flow statement, and top sheet budget to be invaded in the business plan and function as the basis for many of the financial sections of other documents

The Three points above are heavily outlined in my business planning blog series.

Related: How to write an independent Film Business Plan (1/7)

Backed Debt

A secured loan backed by something like a tax incentive or pre-sale agreement.

Unbacked Debt

An unsecured loan, or debt without backing. Generally very high interest.

Financial Gap

The space between what you are able to raise and the amount you need to finish your project.

Financial Markets

A market where stocks, bonds, derivatives, or other securities are bought and sold. Common examples in the US would be the DOW and the NASDAQ.

Film Market

A convention where films are bought and sold primarily by sales agents and distributors. For more, check out the link below.

Related: What is a film market and how does it work?

Gross Domestic Product (GDP)

The total value of all newly finished goods in a given country during a set timespan. Most commonly calculated on an annual basis.

Recession

A macroeconomic term signifying a period of a significant decline in economic activity. It’s generally only recognized after two consecutive quarters of down financial markets.

Depression

A severe recession that lasts longer than 3 years and corresponds with a drop in GDP of at least 10%

Bull Market

A market that’s strong and growing. It’s called a bull market as the upward trending graph looks like a bull nodding its head according to some people on Wall Street.

Bear Market

Yes, I spelled that right. It’s a financial market that’s going down, or staying stagnant. The name comes from a bear swiping its claws down. Probably the same wall street guy came up with it.

Thanks so much for reading! If you liked this, please make sure to check out last week’s general financing glossary, as well as my glossary of distribution terms. Also, please share. It helps A LOT.

Filmmakers Glossary of Business Terms

Additionally, make sure you grab my free Film Business Resource Package to get a print ready PDF version of all 3 glossaries.

Check the tags below for more related content.

Filmmakers Glossary of Film Business Terminology.

I’m not a lawyer, but I know contracts can be dense, confusing, and full of highly specific terms of art. With that in mind, here’s a glossary of Art. Here’s a glossary to help you out.

A colleague of mine asked me if I had a glossary on film financing terms in the same way I wrote one for film distribution (which you can check out here.) Since I didn’t have one, I thought I’d write one. After I wrote it, it was too long for a single post, so now it’s two. This one is on general terms, next week we’ll talk about film investment terms. As part of the website port, I’m re-titling the first part to a general film business glossary of terms, to lower confusion on sharing it. It’s got the same terms and the same URL, just a different title.

Capital

While many types exist, it most commonly refers to money.

Financing

Financing is the act of providing funds to grow or create a business or particular part of a business. Financing is more commonly used when referring to for-profit enterprises, although it can be used in both for profit and non-profit enterprises.

Funding

Funding is money provided to a business or non-profit for a particular purpose. While both for-profit and non-profit organizations can use the term, it’s more commonly used in non-profit media that the term financing is.

Revenue

Money that comes into an organization from providing shrives or selling/licensing goods. Money from Distribution is revenue, whereas money from investors is financing, and donors tend to provide funding more than financing, although both terms could apply.

Equity

A percentage ownership in a company, project, or asset. While it’s generally best to make sure all equity investors are paid back, so long as you’ve acted truthfully and fulfilled all your obligations it’s generally not something that you will forfeit your house over. Stocks are the most common form of equity, although films tend not to be able to issue stocks for complicated regulatory reasons and the fact that films are generally considered a high-risk investment.

Donation

Money that is given in support of an organization, project, or cause without the expectation of repayment or an ownership stake in the organization. Perks or gifts may be an obligation of the arrangement.

Debt

A loan that must be paid back. Generally with interest.

Deferral

A payment put off to the future. Deferrals generally have a trigger as to when the payment will be due.

“Soft Money"

In General, this refers to money you don’t have to pay back, or sometimes money paid back by design. In the world of independent film, it’s most commonly used for donations and deferrals, tax incentives, and occasionally product placement. It can have other meanings depending on the context though.

Investor

Someone who has provided funding to your company, generally in the form of liquid capital (or money.)

Stakeholder

Someone with a significant stake in the outcome of an organization or project. These can be investors, distributors, recognizable name talent, or high-level crew.

Donor

Someone who has donated to your cause, project, or organization.

Patron

Similar to donors, and can refer to high-level donors or financial backers on the website Patreon. For examples of patrons, see below. you can be a patron for me and support the creation of content just like this by clicking below.

Non-Profit Organizations (NPO)

An organization dedicated to providing a good or service to a particular cause without the intent to profit from their actions, in the same way, a small business or corporation would. This designation often comes with significant tax benefits in the United States.

501c3

The most common type of non-profit entity file is to take advantage of non-profit tax exempt status in the US.

Non-Government Organization (NGO)

Similar to a non-profit, generally larger in scope. Also, something of an antiquated term.

Foundation

An organization providing funding to causes, organizations and projects without a promise of repayment or ownership. Generally, these organizations will only provide funding to non profit organizations. Exceptions exist.

Grantor

An organization that funds other organizations and projects in the form of grants. Generally, these organizations are also foundations, but not necessarily.

Fiscal Sponsorship

A process through which a for-profit organization can fundraise with the same tax-exempt status as a 501c3. In broad strokes, an accredited 501c3 takes in money on behalf of a for-profit company and then pays that money out less a fee. Not all 501c3 organizations can act as a fiscal sponsor.

Investment

Capital that has been or will be contributed to an organization in exchange for an equity stake, although it can also be structured as debt or promissory note.

Investment Deck (Often simply “Deck”)

A document providing a snapshot of the business of your project. I recommend a 12-slide version, which can be found outlined in this blog or made from a template in the resources section of my site, linked below.

Related: Free Film Business Resource Package

Look Book

A creative snapshot of your project with a bit of business in it as well. NOT THE SAME AS A DECK. There isn’t as much structure to this. Check out the blog on that one below.

Related: How to make a look book

Audience Analysis

One of 3 generally expected ways to project revenue for a film. This one is based around understanding the spending power of your audience and creating a market share analysis based on that. I don’t yet have a blog on this one, but I will be dropping two videos about it later this month on my youtube channel. Subscribe so you don’t miss them.

Competitive Analysis

One of 3 ways to project revenue for an independent film. This method involves taking 20 films of a similar genre, attachments, and Intellectual property status and doing a lot of math to get the estimates you need.

Sales Agency Estimates

One of 3 ways to project revenue for an independent film. These are high and low estimates given to you by a sales agent. They are often inflated.

Related: How to project Revenue for your Independent Film

Calendar Year

12 months beginning January 1 and ending December 31. What we generally think of as, you know, a year.

Fiscal year

The year observed by businesses. While each organization can specify its fiscal year, the term generally means October 1 to September 30 as that’s what many government organizations and large banks use. Many educational institutions tie their fiscal year to the school year, and most small businesses have their fiscal year match the calendar year as it’s easier to keep up with on limited staff.

Film Distribution

The act of making a film available to the end user in a given territory or platform.

International Sales

The act of selling a film to distributors around the world.

Related: What's the difference between a sales agent and distributor?

Bonus! Some common general use Acronyms

YOY

Year over Year. Commonly used in metrics for tracking marketing engagement or financial performance on a year-to-year basis.

YTD

Year to Date. Commonly used in conjunction with Year over year metrics or to measure other things like revenue or profit/loss metrics.

MTD

Month to Date. Commonly used when comparing monthly revenue to measure sales performance. Due to the standard reporting cycles for distributors, you probably won’t see this much unless you self-distribute.

OOO

Out of Office. It generally means the person can’t currently be reached.

EOD

End of Day. Refers to the close of business that day, and generally means 5 PM on that particular day for whatever the time zone of the person using the term is working in.

Thanks for reading this! Please share it with your friends. If you want more content on film financing, packaging, marketing, distribution, entrepreneurialism, and all facets of the film industry, sign up for my mailing list! Not only will you get monthly content digests segmented by topic, but you’ll get a package of other resources to take you film from script to screen. Those resources include a free ebook, whitepaper, investment deck template, and more!

Check the tags below for more related content!

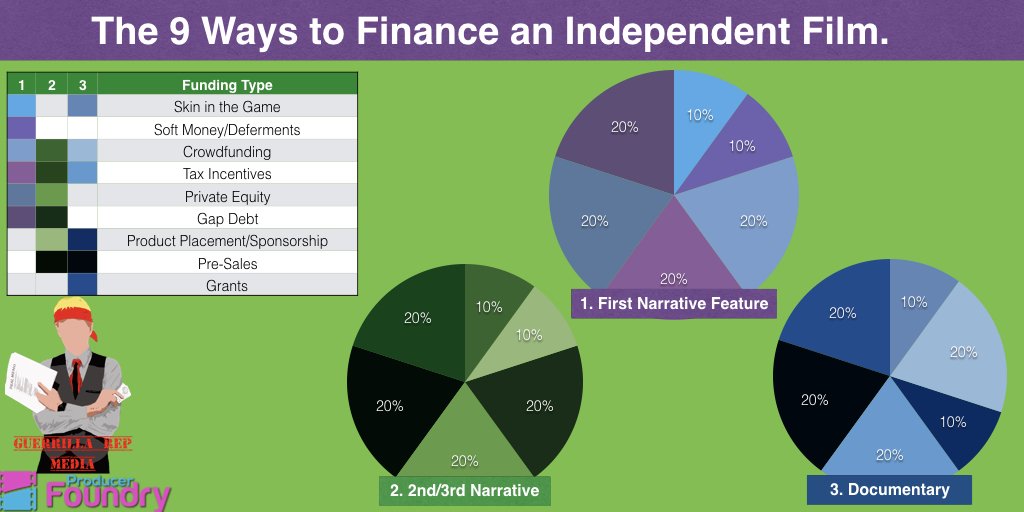

The 9 Ways to Finance an Indiependent Film

There’s more than one way to finance an independent film. It’s not all about finding investors. Here’s a breakdown of alternative indie film funding sources.

A lot of Filmmakers are only concerned with finding investors for their projects. While films require money to be made well, there’s are better ways to find that money than convincing a rich person to part with a few hundred thousand dollars. Even if you are able to get an angel investor (or a few ) on board, it’s often not in your best interest to raise your budget solely from private equity, as the more you raise the less likely it is you’ll ever see money from the back end of your project.

Would you Rather Watch or Listen than Read? I made a video on this topic for my YouTube Channel.

So here’s a very top-level guide to how you may want to structure your financial mix. The mixes in the image above loosely correspond to the financial mix of a first-time film, a tested filmmaker’s film, and a documentary. They’re also loose guidelines, and by no means apply to every situation, and should not be considered financial or legal advice under any circumstance. This is just the general experience of one Executive producer.

Piece 1 — Skin in the game. 10–20%

Investors want you to be risking something other than your time. The theory is that it makes you more likely to be responsible with their money if you put some of yours at risk. This can be from friends and family, but they prefer it come directly from your pocket.

I've gotten a lot of flack for this. However, the fact investors want skin in the game is true for any industry or any business. Tech companies normally have skin in the game from the founders as well, not just time, code, or intellectual property.

However, if you’ve got a mountain of student debt and no rich relatives, then there is another way…

Piece 2 — Crowdfunding 10–20%

I know filmmakers don’t like hearing that they’ll need to crowdfund. I understand it’s not an easy thing to do. I’ve raised some money on Kickstarter and can verify that It’s a full-time job during the campaign if you want to do it successfully. However, if you can hit your goal, not only will you be able to put some skin in the game, and retain more creative control and more of the back end but you’ll also provide verifiable proof that there’s a market for you and your work. Investors look very kindly on this.

That said, just as success provides strong market validation as a proof of concept, failing to raise your funding can also be seen as a failure of concept. and make it more difficult to raise than it would otherwise have been. Make sure you only bite off what you can chew.

Due to the difficulty in finding money for an independent film, the skin in the game or crowdfunding portion of the raise for a director’s first project is often a much higher percentage of the raise than it will be for their future projects.

Piece 3 — Equity 20–40%

Next up is equity. This is when an investor gives you money in return for an ownership stake in the company. From a filmmaker's perspective, it’s good in that if everything goes tits up, you don’t owe the investors their money back. Don't misunderstand what I mean by this. You ABSOLUTELY have a fiduciary responsibility to do your due diligence and act in the best interest of your investors to do absolutely everything in your power to make it so they recoup their investment. If you do that, or if you commit fraud, your investors can and likely will sue the pants off of you. You’ll have an uphill battle on that as well since they probably have more money for legal fees than you do.

Also, you will need a lawyer to help you draft a PPM. You shouldn't raise any kind of money on this list without a lawyer, with the possible exception of donation-based crowdfunding or grants. In general, just remember that I’m a dude who produced a bunch of movies who writes blogs and makes videos on the internet. Not a lawyer or financial advisor. #Notlegaladvice #Notfinancialdvice #mylawyermakesmewritethesesnippets.

It’s bad in that if everything goes extremely well, they get a huge percentage of your film. So it deserves a place in your financial mix, but ideally a small one.

For a longer list of my feelings on this topic, check out Why film needs Venture Capital, or One Simple Tool to Reopen Conversations with Investors

Piece 4 — Product Placement 10–20%

Product placement is when you get a brand to compensate you for including their product in your film. It’s more common in the form of donations or loans for use than hard money, but both can happen with talent and assured distribution. If you’re a first-timer, it’s difficult to get anything other than donated or loaned products.

Piece 5 — Presale Backed Debt 0–20%

Everything you read tells you the presale market has dried up. To a certain degree, that is true. However, it’s more convoluted than you may think. According to Jonathan Wolfe of the American Film Market, the presale market has a tendency to ebb and flow with the rise and fall of private equity in the filmmaking marketplace. There’s been a glut of equity for the past several years that’s quickly drying up.

That said, there are a lot of other factors that will determine where pre-sales end up in a few years. The form has shifted, in that it’s generally reputable sales agents that give the letters instead of buyers and territorial distributors. You then take that letter to a bank where you can borrow against it at a relatively low rate.

Piece 6 — Tax incentives 10%-20%

While many states have cut their filmmaking tax incentives, it’s still a very viable way to cover some of the costs of making your project. It is worth noting that the tax incentive money is generally given as a letter of credit, which you can then borrow against or sell to a brokerage agency. It’s not just a check from the state or country you’re shooting in. This system of finance is significantly more viable in Europe than it is in the US, but no matter where you plan on shooting it needs to be part of your financial mix.

Piece 7 — Grants 0–20%

There are still filmmaking grants that can help you to make your project. However, that’s not something that is available to all filmmakers, especially when they’re first making their projects. Don’t think grants don’t exist for you and your project, because they probably do, spend an afternoon googling it. My friend Joanne Butcher of www.FilmmakerSuccess.com suggests applying for one grand a month for the indefinite future, as when you do so you’ll develop relationships with the foundations you contact which can be invaluable for your career growth.

Grants are much easier to get as a completion fund once you’ve shot your film. Additionally, films made overseas are more likely to be funded by grants than those shot here in the US.

Piece 8 — Gap/Unsecured Debt 10–40%

Gap debt is an unsecured loan used to create a film or television series. This means that the loan has no collateral, be it product placement, Presale, or tax incentive. It used to be handled by entertainment banks for a very high interest rate, I can’t say who my source was on this, but I have heard of interest rates in excess of 50% APR. That market has been largely taken over by private investors loaning money through slated, which did bring interest rates down. Unsecured debt almost certainly requires a completion bond, which generally means that it’s only suitable for projects over 1mm USD in budget.

In general, you should use this form of financing as little as possible, and pay it back as quickly as possible. Again, Not legal or financial advice.

Piece 9 — Soft money and Deferments — whatever you can

Soft money is funding that isn’t given as cash. This can be your crew taking deferred payment for their services, or receiving donated or loaned products, locations, and anything else meant to get your film made. This isn’t so much funding as cost-cutting. It often includes donations or loans from product placement.

If you like this content and want to learn more about film financing, you should consider signing up for my mailing list. Not only will you a free e-book, but you’ll also get a free deck template, contract tracking templates, and form letters. Plus you’ll stay in the know about content, services, and releases from Guerrilla Rep Media.